Getting Ready for Tax Season: Free Tax Preparation Resources! - 1/20/22

Getting Ready for Tax Season: Free Tax Preparation Resources! - 1/20/22

Learn about free tax preparation resources that are available to you!

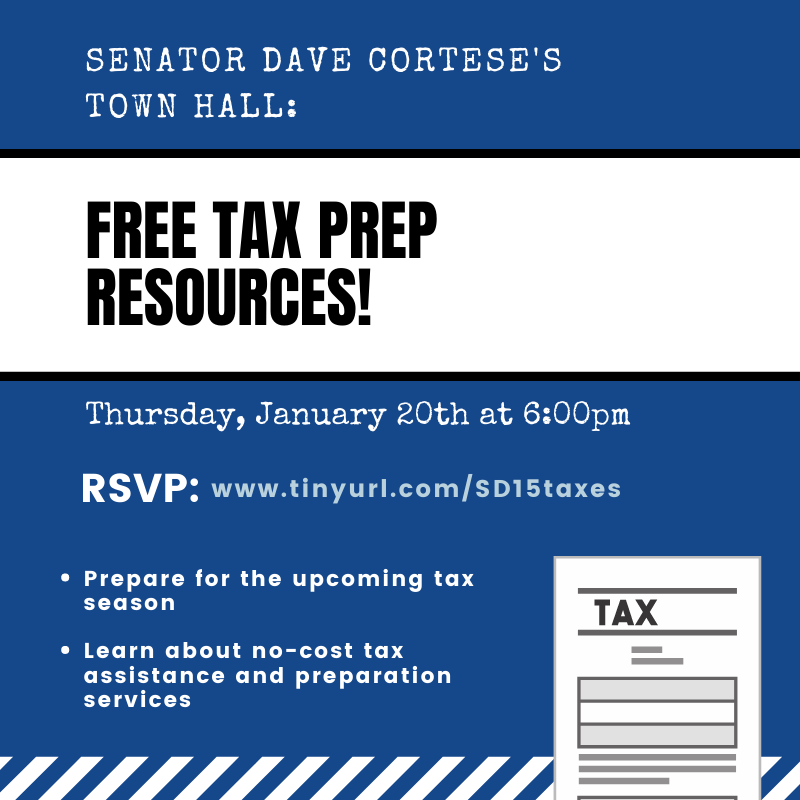

Join Senator Dave Cortese's Town Hall January 20th at 6:00pm for an informative presentation and Q&A discussion to get you ready for the 2022 tax season. Hear from representatives of the Franchise Tax Board, United Way Bay Area, and others to learn about services available to you including no-cost tax assistance and preparation services.

Register to attend the event at www.tinyurl.com/SD15Taxes.

The California Earned Income Tax Credit (CalEITC), California Young Child Tax Credit, federal EITC and federal Child Tax Credit may reduce the amount of taxes you owe or increase your refund. To see if you qualify for these credits or other benefits, and to find free tax prep help near you, go to CalEITC4me.org.

CalEITC is a refundable state tax credit for low-income families who may also quality for the Young Child Tax Credit (YCTC). These tax credits put money back into the pockets of families; the amount they receive varies based on income and qualifying number of dependents.

CalEITC Eligibility:

- 18 years old or have a qualifying child

- Income of about $30,000 or less

- Earned at least $1 in 2020

YCTC Eligibility:

- Qualify for the CalEITC

- Child under the age of 6

This Town Hall will be hosted through ZOOM. It will be also live-streamed, with closed captioning options, and made available for later viewing through Senator Cortese’s Facebook page and website.